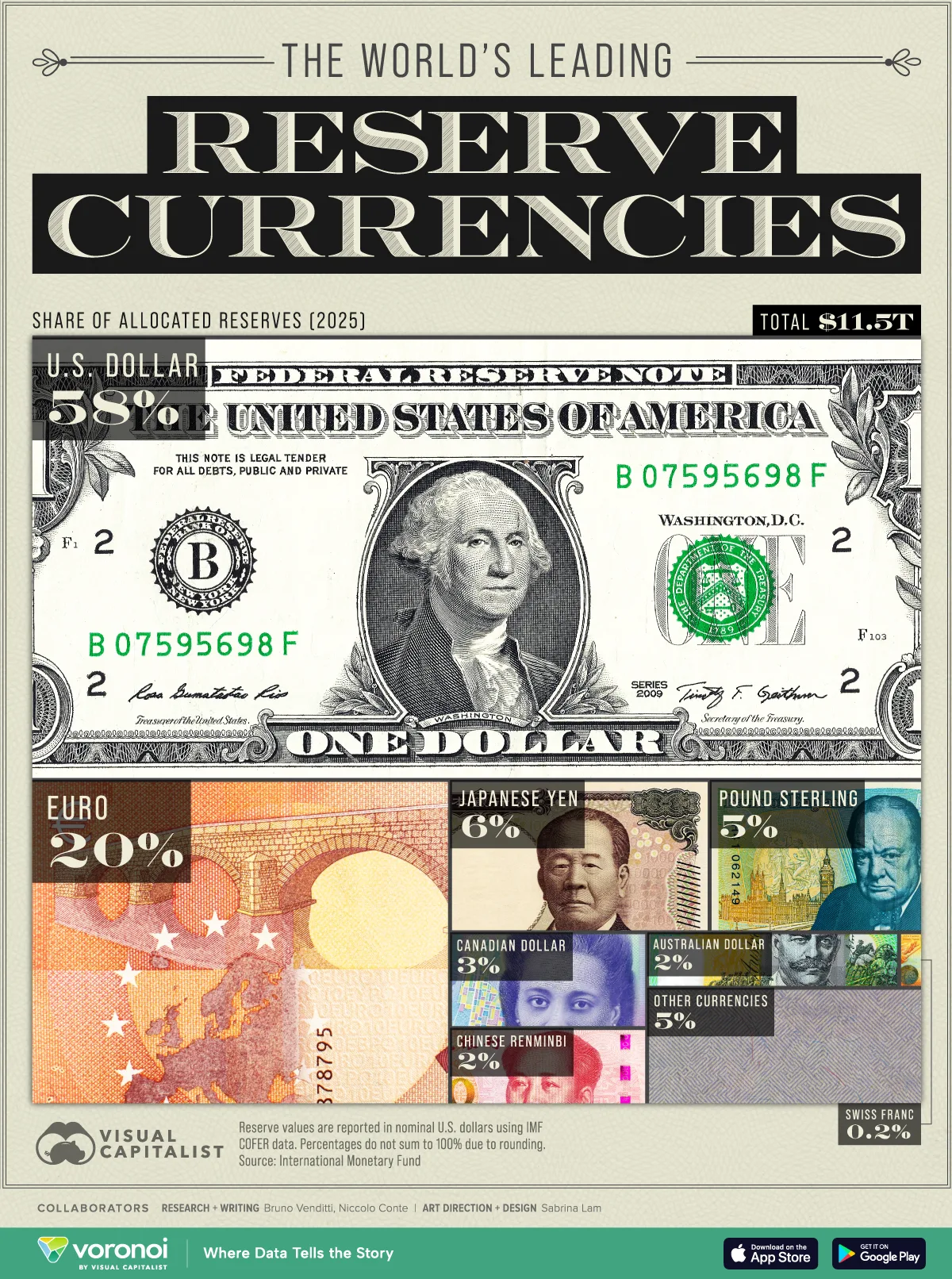

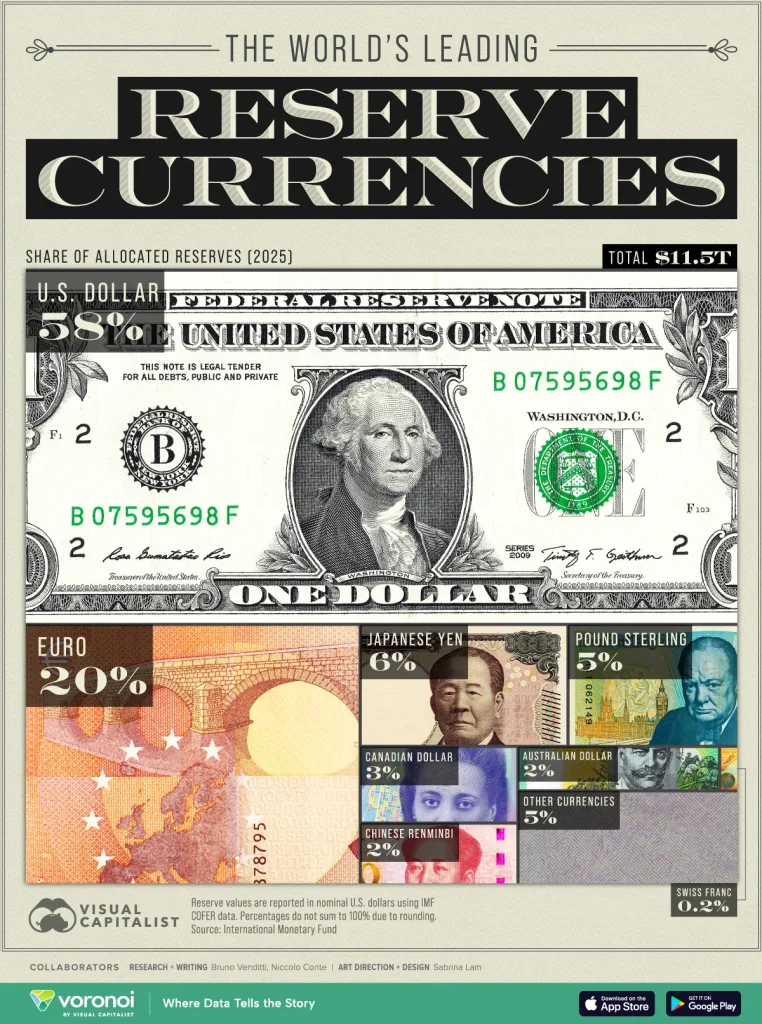

INFOGRAPHIC/VISUAL CAPITALIST/Design/Sabrina Lam

By SPECIAL CORRESPONDENT

The U.S. dollar remains the world’s dominant reserve currency, accounting for nearly 58% of global reserves according to data from the International Monetary Fund (IMF).

According to Visual Capitalist, the data shows that while the dollar’s share has declined over time, no single alternative currency has emerged as a clear replacement. Notably, while China’s yuan has gained visibility in global trade and finance, it still represents just over 2% of global reserves.

Central bank reserve holdings are used to stabilize currencies, settle international trade, and manage financial crises.

The above visualization ranks the world’s leading reserve currencies, showing how global reserves are distributed across major currencies today. The data for this visualization comes from the International Monetary Fund, using COFER (Currency Composition of Official Foreign Exchange Reserves) data. Reserve values are reported in nominal U.S. dollars.

The U.S. dollar remains the backbone of the global reserve system, with central banks holding approximately $6.6 trillion in dollar-denominated reserves. This represents nearly 58% of total reported global reserves.

Despite frequent discussions around de-dollarization, the dollar continues to benefit from deep U.S. financial markets, global trade invoicing, and its role as a safe-haven asset during periods of uncertainty.

The euro ranks second, accounting for nearly $2.3 trillion, or about 20% of global reserves.

Beyond the dollar and the euro, reserve holdings are spread across several smaller currencies. The Japanese yen and British pound together account for roughly 11% of global reserves, reflecting their long-standing financial stability and deep markets.

Other currencies, including the Canadian and Australian dollars, the Chinese yuan, and the Swiss franc, each hold relatively small shares.

Notably, while China’s yuan has gained visibility in global trade and finance, it still represents just over 2% of global reserves.