What exactly does the current wave of debt default and IMF, World Bank-inspired solutions hold for African economies and African people? PHOTO/SHUTTERSTOCK

By MORRIS ODHIAMBO

Those who do not understand their history, it is often said, are bound to repeat its mistakes! This is what came to my mind when news of Ethiopia’s debt default filtered through a couple of weeks ago.

A lot of the conversations in regard to this subject, as is usually the case with emotive issues such as debt in Africa, have failed to shed much light on the issue.

Many commentators barely touched the surface of what is going on on the African continent and reflect on the historical and immediate foundations of the unfolding crisis. Few pundits borrowed lessons from the past to shed light on the present.

Perhaps, as usual, a more critical appraisal of the situation will be left to the Economist and Washington Post, and other neoliberal mouthpieces, to shape the narrative as they wish!

For me, the relevant questions are the following: Are African economies back to the crises of the early 1980s and the subsequent introduction of the Structural Adjustment Programmes (SAPs)?

Are we effectively back to the period after the early promise of the 1960s and 1970s when African economies crushed and needed to be rescued by International Financial Institutions (IFIs)? Are we back to the pains of the 1980s and 1990s shaped by the SAPs and the social problems that period heralded?

What exactly does the current wave of debt default and IMF, World Bank-inspired solutions hold for African economies and African people? What lessons did African economists learn from the earlier crisis and how useful can those lessons be, today?

SAPs were/are a set of policies that were designed by the IMF and WB with the stated intention of adjusting a borrower country’s economic structure, to improve their international competitiveness and restore balance of payments.

The real purpose of SAPs, however, was to continue the lopsided integration of Africa’s economies into the international economic system by encouraging liberalization, privatization and removal of all barriers to so-called free trade. These policies were later codified by Western economists into something called the Washington Consensus.

It was the Washington Consensus that cemented economic neo-liberalism as we understand it today. Importantly, it was the debt crisis that was used as a pretext to advance the neoliberal agenda.

Ethiopia is not the first country in Africa to default in the current wave. It follows closely behind Zambia and Ghana. For some time now, the possibility of African countries defaulting on debt has been on the cards. By 2022, a number of countries were already at advanced levels of debt distress. These include Ghana, Egypt, Tunisia, Malawi and Zambia.

How IMF country level oversight or bilateral surveillance works. INFOGRAPHIC/IMF

The factors discussed in relation to this situation include rising inflation in some of the countries and escalating borrowing costs compounded by a strong dollar and Covid-19-related disruptions.

Of course, no one talks about the years of wanton wastage of public funds and complete lack of accountability on the part of politicians and bureaucrats running, nay, ruining African economies.

In the late 1970s, when African economies faced similar conditions they face today, they formulated the Lagos Plan of Action (LPA) and the Final Plan of Lagos (FAL) to create a pathway for the economic progress of the continent.

It is the FAL that committed African governments to establish the African Economic Community (AEC) by 2000. The World Bank then reacted by setting up its own assessment of the challenges facing African economies, coming up with the Accelerated Development in Sub-Saharan Africa: An Agenda for Action (Berg Report).

One of the key conclusions of the Berg report was that Africa would not go far if “the market were not allowed to introduce economic rationality in development choice-making” (Anyang’ Nyong’o, et al [2002]). Pushed to the wall, African countries came up with the “Africa’s Priority Programme for Economic Recovery” (APPER).

Since African economies required rescuing straight away, they were forced to implement the SAPs, a kind of shock therapy that required immediate withdrawal (or fundamental reduction) of the state from social spending in health, education, etc.

As the situation is unfolding now, it is clear that African people are getting caught up (once again) between a rapacious, predatory and arrogant political and bureaucratic class that believes in wanton spending and looting, and an international bureaucracy designed to serve the interests of international capital.

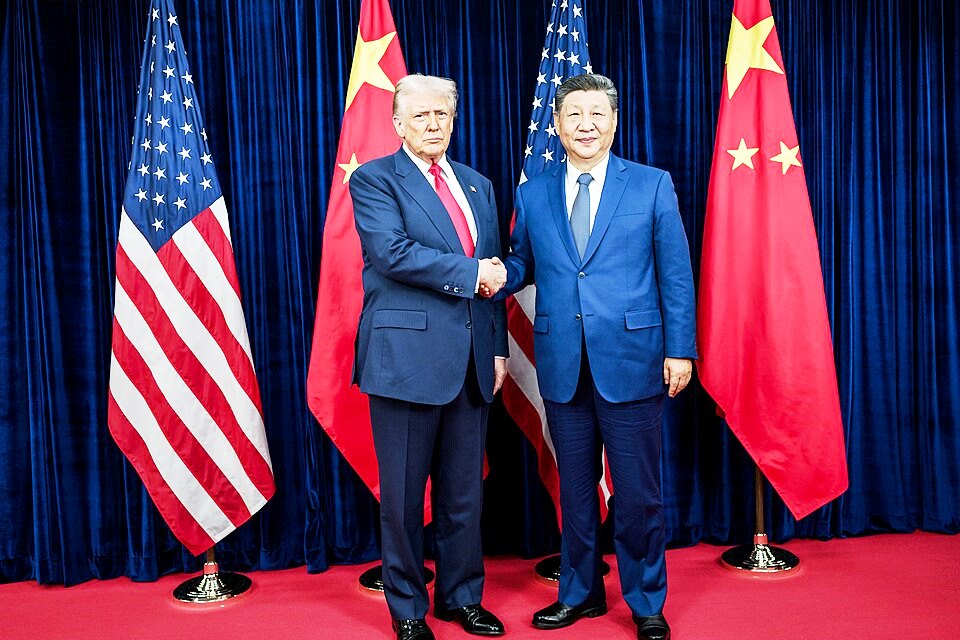

All this is happening on the backdrop of the West’s competition with China for Africa’s resources and the continent’s inability to negotiate for better terms for its primary products. No wonder, then, that Africans across the continent celebrated the July 26th military takeover in Niger!

The writer is vice-chairman, Diplomacy Scholars Association of Kenya (DIPSAK) and coordinator, Missing Voices Coalition (MVC) in Kenya.