U.S. Federal Bureau of Investigation (FBI) has expanded its probe into Nairobi. PHOTO/UGC.

By PATRICK MAYOYO

A sprawling fraud network in Minnesota, USA, involving over $18 billion in stolen funds, has triggered a wave of investigations that have now raised uncomfortable questions about Kenya’s real estate sector.

The money trail, which led investigators to Nairobi, has revealed troubling links between the fraudulent schemes in the United States and high-end property acquisitions in the Kenyan capital.

The U.S. Federal Bureau of Investigation (FBI) has expanded its probe into a network of fraudulent schemes that siphoned millions of dollars through fake welfare, childcare, housing, and healthcare programmes.

These programmes, which largely existed only on paper, funneled vast amounts of public funds into shell companies and phony vendors, much of which was then laundered overseas.

Among the countries implicated is Kenya, where the illicit cash flow has been traced to the booming, yet suspiciously inflated, real estate market in Nairobi and along the Kenyan Coast.

Court filings and federal briefings reveal that a portion of the embezzled funds were directed towards the purchase of luxury properties in Nairobi, notably in upmarket areas such as Westlands, Eastleigh, Hurlingham, and South B.

These districts have been at the centre of a real estate boom in recent years, with new developments mushrooming in a seemingly unstoppable trend. However, the revelation of this multi-billion-dollar fraud has cast doubt on the sustainability of this boom, as questions about the true source of investments arise.

The investigation into the fraud network, which also encompasses alleged bribery and fraud within the Somali diaspora in Minnesota, was propelled by the investigative work of independent journalist Nick Shirley.

Nick Shirley, a 23-year-old YouTube creator who exposed the high profile scam. Nick Shirley/Youtube

Shirley’s exposé on YouTube, which has garnered over 1.5 million views, documented empty, government-funded childcare centres receiving millions in taxpayer dollars, sparking national outrage.

His work reignited public debate on the scale of fraud taking place, particularly involving the “ Feeding Our Future” programme, which defrauded the government of over $32 billion meant to provide meals to children during the COVID-19 pandemic.

As part of the ongoing investigation, the FBI has mobilised additional resources and agents to Minnesota, focusing on uncovering the full extent of money laundering and fraud schemes.

The scandal has already led to 78 indictments and 57 convictions, with many of those involved connected to Minnesota’s large Somali community. The FBI has warned that the scale of the operation may extend far beyond what has been uncovered so far, with agents following the money to international destinations, including Kenya.

In Kenya, the revelations have triggered panic among local investors in the real estate sector. Many fear that their properties, some of which may have unknowingly benefited from illicit funds, could be subject to confiscation or further scrutiny.

The fear is palpable as the probe into the stolen funds intensifies, with both the FBI and the Department of Homeland Security increasing personnel to investigate fraud in Minnesota, particularly at Somali-run childcare centres.

The Kenyan real estate market, particularly in Nairobi, has seen remarkable growth in recent years, with developers rushing to capitalise on the booming demand for residential, commercial, and luxury properties.

From the posh neighbourhoods of Westlands and Lavington to the rapidly developing satellite towns like Ruaka and Kiambu, Nairobi’s real estate landscape has become a magnet for both local and foreign investors.

Areas once considered peripheral, such as Eastleigh, South B, and even parts of Hurlingham and Kileleshwa have transformed into sought-after locations for both housing and office space.

This rapid expansion, however, has been accompanied by signs of volatility. The market has been plagued by soaring property prices, the construction of high-end buildings that often remain under-occupied, and a growing sense of oversupply in certain segments, especially luxury apartments.

U.S. Federal Bureau of Investigation (FBI) director Kash Patel said FBI has expanded its probe into Nairobi. PHOTO/UGC.

Speculation has run rampant, with some analysts warning that the sector is in danger of becoming a bubble, one that could bust under the weight of unrealistic valuations and, as it turns out, potentially fraudulent money inflows.

Historically, Nairobi’s real estate boom has been fueled by several factors: a growing middle class, increasing foreign direct investment, and the city’s status as a regional economic hub.

The development of new infrastructure, including the Nairobi Expressway and improved transport links, has made suburban areas more accessible, further driving demand. However, alongside these legitimate drivers of growth, an influx of illicit capital has raised concerns.

For several years, real estate professionals have raised alarms about the opaque sources of some investments in the sector, particularly those linked to foreign entities or individuals with unclear backgrounds.

While Kenya has seen an influx of overseas investors, particularly from the Middle East and Asia, the involvement of stolen funds from international fraud schemes, as exposed in Minnesota, paints a troubling picture.

Properties bought with illicit funds, whether from stolen public money or money laundering operations, have the potential to undermine the integrity of the market and make it harder for legitimate investors to compete. The FBI’s investigation into the fraud network has already led to heightened scrutiny of the Kenyan real estate sector.

Panicked investors fear that the Kenyan government, pressured by international law enforcement agencies, may be forced to investigate the origins of certain property deals, potentially leading to the confiscation of properties linked to criminal enterprises. While it remains unclear how extensive the fraud connections in Kenya are, the threat of asset seizures has caused unease within the market.

Department of Homeland Security Secretary Kristi Noem said investigations are ongoing in Minneapolis. PHOTO/UGC.

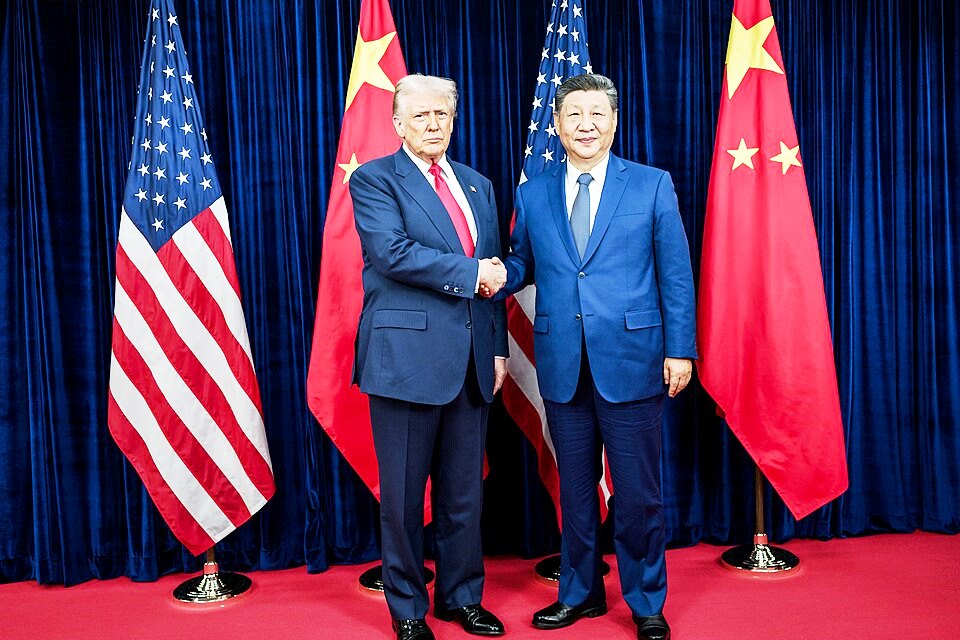

The political fallout from the revelations has been swift. The Trump administration’s anti-immigrant rhetoric has taken centre stage, with Vice President JD Vance criticising the alleged fraudsters as “stealing both money and political power from Minnesotans.”

In response, FBI Director Kash Patel reiterated the agency’s commitment to tackling fraud, noting that the investigation is far from over, and that efforts to recover the stolen funds are ongoing.

At the heart of the controversy lies the Somali community in Minnesota, which has become a focal point for both fraud investigations and political attacks. The FBI’s crackdown, coming shortly after the viral release of Shirley’s video, has added fuel to the fire of anti-Somali sentiment.

President Donald Trump’s derogatory remarks about the Somali diaspora in Minnesota, coupled with an increase in Immigration and Customs Enforcement (ICE) operations targeting undocumented immigrants, have intensified fears within the community.

The broader implications of this investigation for Kenya’s real estate market are yet to be fully understood. While the Kenyan government has not publicly commented on the allegations, the sudden surge in property acquisitions linked to fraud rings in Minnesota raises urgent questions about the integrity of the country’s real estate boom. With many properties likely tainted by this illicit funding, the future of Nairobi’s booming real estate sector now hangs in the balance.

As investigations continue, there is growing concern about the long-term consequences for both countries. For now, the focus remains on tracing the money and holding those responsible to account, both in the U.S. and abroad.

However, the exposure of this vast fraud operation has served as a stark reminder of the complexities of global money laundering and its deep ties to emerging markets like Kenya.

Nairobi’s real estate sector may soon face a reckoning. While Kenya has long been a favourable investment destination due to its strategic position in East Africa and growing economy, the involvement of illicit capital in the property market casts a shadow over the integrity of future investments.

Whether this scandal will prompt regulatory reforms or greater scrutiny of foreign money flows into the country remains to be seen, but one thing is clear: Nairobi’s real estate boom may be far more precarious than it first appeared.