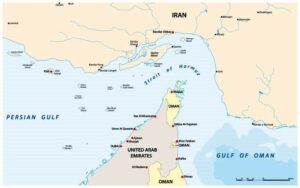

Maritime experts say the closure of the Strait of Hormuz would benefit Mombasa port in short-term but eventually led to delays and congestion. PHOTO/FILE.

By PATRICK MAYOYO

The news that Iran’s parliament has unanimously voted to close the Strait of Hormuz, with the final decision now resting in the hands of the country’s supreme leader Ali Khamenei, has sent shockwaves through the global supply chain.

The Strait of Hormuz is one of the most critical maritime chokepoints globally, through which roughly 20 percent of the world’s oil supply transits daily. It connects the Persian Gulf to the Arabian Sea and serves as a crucial conduit for both oil and non-oil trade.

Maritime experts say any significant disruption in its operation, such as Iran’s recent parliamentary vote to close it, could send shockwaves throughout the global economy.

“Closing the Strait of Hormuz would have immediate and far-reaching consequences for the maritime industry, particularly for the shipping sector that relies on this strategic waterway to transport goods, especially oil,” a maritime official at Mombasa port said.

The most direct effect would be on oil tankers. Around 17 million barrels of oil pass through the Strait daily, mostly bound for Asian markets, including China, Japan, and India. Should Iran close the Strait, these tankers would be forced to take alternative, longer routes. This could cause significant delays and increase the operational costs of tanker vessels.

Given that tankers account for a major portion of global oil shipping, the consequences could be stark. Some routes, such as around the Cape of Good Hope (around the southern tip of Africa), would add significant transit time; potentially up to two weeks depending on the ship’s destination. This would not only increase fuel costs but also raise the risks of piracy, particularly in the Gulf of Aden.

Aside from oil tankers, the Strait is also a crucial route for other types of cargo. Goods ranging from consumer electronics to industrial machinery make their way through the Persian Gulf, and any blockage would disrupt these essential global supply chains. The diversion of such goods would burden shipping companies with additional logistical and operational challenges.

Moreover, the maritime security situation in the region would likely worsen, given that any attempt to close the Strait could lead to military escalation, piracy, or even sabotage. In turn, this would elevate the risk profile for shipping companies operating in these waters, pushing up insurance premiums and freight costs.

The closure of the Strait of Hormuz would create a series of cascading effects on global trade and the global supply chain, as oil and gas are foundational to the functioning of modern economies.

Oil prices would almost certainly rise sharply, given the immediate supply constraints. With the Strait of Hormuz blocked, the world would lose access to a major source of crude oil, especially affecting markets in Asia.

The immediate effects would be seen in rising petrol and diesel prices, but long-term consequences could involve widespread inflation as the price of all goods tied to the cost of energy increases.

Global supply chains are highly sensitive to fluctuations in energy prices, and this would have immediate downstream effects. The manufacturing sector, which relies heavily on affordable and stable energy prices, would face higher production costs. This could lead to slower economic growth in major industrial economies, particularly those that rely on energy imports.

Although oil is the primary commodity affected, the closure of such a vital shipping lane would not only disrupt the oil supply. Non-oil commodities, such as metals, agricultural products, and industrial goods, are also transported via this maritime route.

Countries like Japan, South Korea, and India that import a wide range of goods through this shipping lane would be forced to look for alternative routes, increasing shipping times and costs.

As the cost of transporting goods increases due to rerouted vessels, the cost of doing business for firms dependent on maritime transport will rise sharply. These increases in shipping costs will be passed down the supply chain, leading to higher costs for end consumers.

The immediate effect of a shipping bottleneck caused by a blockage of the Strait would be a sharp increase in the price of oil, leading to a rise in transportation costs across the board. This could ripple through to the cost of goods and services globally, contributing to inflationary pressures, particularly in countries that rely heavily on imported goods.

For example, global transportation networks for goods such as electronics, automobiles, and consumer goods would face delays and increased shipping charges. This would cause a rise in the cost of imported goods, which could, in turn, result in inflation. In a period of already high inflation, particularly in the aftermath of the COVID-19 pandemic, this could exacerbate economic instability.

Companies that rely on just-in-time (JIT) supply chain models would be particularly vulnerable. Any significant delay or disruption in the availability of goods could affect production schedules, especially for sectors like automotive manufacturing, consumer electronics, and pharmaceuticals. This disruption would lead to production delays and stock shortages, forcing companies to raise prices in order to maintain profitability.

For example, the automotive industry, which often relies on parts imported via the Strait of Hormuz, would face significant challenges in sourcing components. This would directly lead to higher vehicle prices and production delays.

Energy prices, especially for crude oil, would likely see a sharp spike. Many industries are heavily reliant on energy, and higher prices would increase the cost of production across sectors. Companies would either absorb these higher costs, reducing their margins, or pass them on to consumers, further pushing up the cost of living.

The global economy is highly interconnected, and disruptions to vital trade routes can trigger a global economic shock. The closing of the Strait of Hormuz would have severe economic costs that go beyond just oil prices and the supply chain disruptions outlined above.

The total cost to the global economy would depend on how long the Strait remains closed. A closure lasting for a matter of weeks could lead to billions in lost economic output, particularly in countries dependent on oil imports. Economies in Europe and Asia that rely on the free flow of oil from the Persian Gulf would be hit hardest.

The global GDP could shrink in response to the direct and indirect costs of such a closure. A prolonged disruption could reduce economic output, especially for countries in the Middle East, Asia, and Europe that rely on Gulf oil and gas.

Oil-producing countries, especially those in the Gulf Cooperation Council (GCC) states, would see a collapse in revenue as oil prices spike, and the volume of oil exports is constrained. Countries like Saudi Arabia, the UAE, and Kuwait would experience economic volatility, with potential impacts on their fiscal stability. In contrast, oil-importing nations would face significantly higher costs of energy and related goods, further stalling economic recovery.

A disruption of this magnitude could lead to turbulence in global financial markets, especially in the oil markets. Speculation in commodity markets would drive up oil prices, and stock markets could experience large swings.

Iran supreme leader Ayatollah Ali Khamenei. PHOTO/UGC.

This uncertainty could increase the cost of capital for businesses globally, particularly for industries reliant on energy-intensive processes.

A shipping agent in Kenya said ports in Africa, particularly those on the East African coast such as the Port of Mombasa in Kenya, could see varying degrees of impact from a closure of the Strait of Hormuz.

The maritime official said if the Strait of Hormuz were closed, shipping companies would look to reroute vessels to avoid the region, including those that currently pass through the Gulf of Aden.

“The Port of Mombasa might experience an influx of vessels seeking to bypass the Middle East,” he said.

This would lead to an increase in port activity, but could also create challenges related to port congestion, increased logistical burdens, and the potential for delays.

Kenya’s economy, which is heavily reliant on trade, particularly exports of tea, coffee, and fresh produce, could be disrupted if shipping routes are delayed.

Mombasa serves as a gateway for trade not only for Kenya but also for landlocked nations in East Africa. Any disruption in maritime logistics would affect import-export cycles, leading to delays in deliveries and higher transport costs.

Additionally, should oil prices rise as a result of the closure, African countries that are net oil importers, such as Kenya, would face higher fuel costs. This would affect both local transportation costs and the prices of consumer goods, contributing to inflation.

The potential closure of the Strait of Hormuz by Iran is a geopolitical and economic event with the capacity to disrupt global trade, affect maritime activities, and create significant economic costs.

The implications for global trade are profound: oil prices would rise, global supply chains would be disrupted, and the cost of doing business would increase, leading to higher costs for goods and services.

The closure would also have significant ramifications for specific regions, especially for maritime hubs such as the Port of Mombasa. Global economies, particularly those dependent on energy imports or oil shipments through the Strait, would feel the economic strain for the duration of any closure.

This scenario underscores the fragile interconnectedness of global trade routes and highlights the critical importance of maintaining secure and open maritime passageways in safeguarding the global economy.