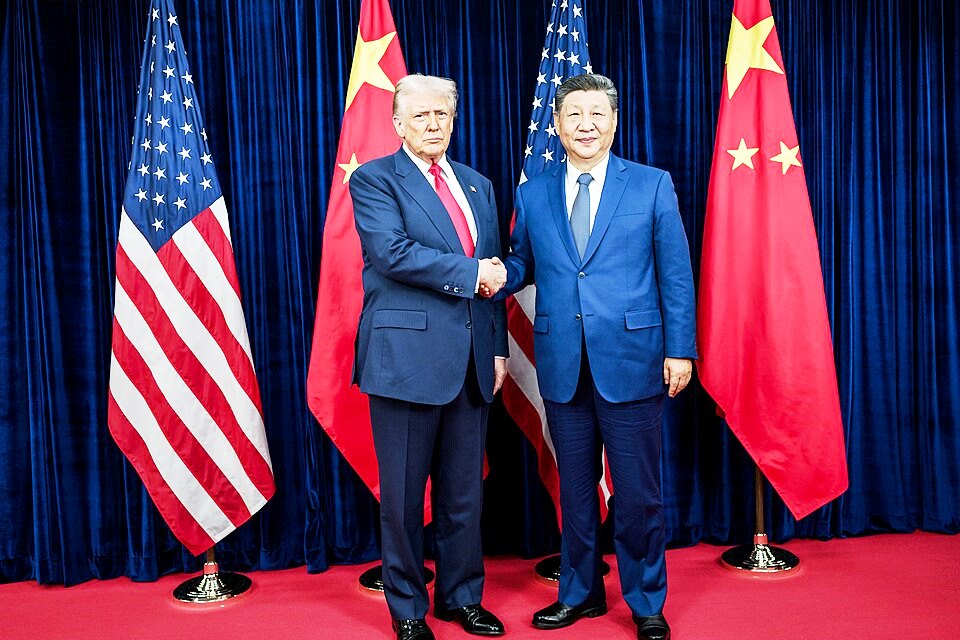

African Development Bank (AfDB) Group President Dr. Akinwumi Adesina, being interviewed by CNN’s Christiane Amanpour. PHOTO/UGC.

By DICK MUTSAMI

As the United States escalates its global tariff regime, Dr Akinwumi Adesina, President of the African Development Bank Group, has warned about the potential economic fallout for African nations.

Speaking to CNN’s Christiane Amanpour, Adesina cautioned that the ripple effects could be extensive, disrupting export revenues, weakening foreign exchange reserves, and triggering inflation across the continent.

According to Adesina, 47 of Africa’s 54 countries stand to be directly impacted by Washington’s new trade stance, with some already facing tariff increases of up to 50 percent on a wide range of goods. Countries including Lesotho, Madagascar, Mauritius, Botswana, Angola, Algeria and South Africa are among the hardest hit.

The situation is compounded by significant reductions in USAID funding, which is already impeding access to vital medical supplies and humanitarian assistance, casting uncertainty over the future of US-Africa relations.

Africa’s Trade Strategy: Diversification and Regional Integration

Despite the risks, Adesina was clear that Africa must avoid engaging in a trade confrontation with the United States. The continent represents just 1.2% of total US trade (circa \$34 billion), with a modest trade surplus of \$7.2 billion. Instead, he outlined a pragmatic three-pronged approach:

- Constructive engagement with the US through flexible trade negotiations;

- Diversification of export markets to mitigate reliance on any single trading partner;

- Acceleration of the African Continental Free Trade Area (AfCFTA) to harness the continent’s \$3.4 trillion market potential.

Adesina called for stronger domestic markets, improved savings rates, and increased value addition to exports, particularly in sectors such as critical minerals—including cobalt and lithium—where Africa holds a comparative advantage.

He dismissed binary narratives of geopolitical alignment, noting, “The US is a key ally of Africa—and so is China. Africa is building bridges, not walls.” He added that the continent seeks equitable, transparent, and African-led partnerships with all major economic powers, including the EU and Gulf states.

Redefining Development: From Aid Dependency to Self-Reliance

With his second term as AfDB President concluding in September, Adesina reiterated his longstanding position on aid reform. “The era of traditional aid is over,” he asserted, urging for a pivot towards concessional financing and large-scale investment in infrastructure, industrialisation, and domestic capital mobilisation.

Highlighting the role of the African Development Fund, the Bank’s concessional arm, Adesina noted that every \$1 of funding leverages \$10 in capital, empowering 37 low-income countries to tackle critical development challenges such as climate change, gender inequality, and fragile state governance.

While Africa accounts for nearly 20% of the global population but under 3% of global GDP, its economic momentum is unmistakable. Ten of the world’s 20 fastest-growing economies are African, according to Adesina, who cited the Bank’s “High 5” agenda—focusing on energy, food security, industrialisation, regional integration, and quality of life—as having impacted more than 565 million lives.

Investment Outlook: Infrastructure, Energy and the Africa Investment Forum

With more than \$55 billion invested in infrastructure over the past decade, the AfDB is the continent’s leading infrastructure financier. Flagship projects like Mission 300, a joint effort with the World Bank aiming to provide electricity access to 300 million Africans by 2030, underscore the scale and ambition of the Bank’s initiatives. “You can’t industrialise in the dark,” Adesina said.

He also hailed the Africa Investment Forum (AIF), launched in 2018 with eight institutional partners. The AIF has mobilised over \$225 billion in investment interest, advancing numerous projects from conceptual stage to financial closure.

Despite current challenges, Adesina remains bullish on Africa’s investment prospects. “Africa is the world’s greatest greenfield investment frontier,” he concluded.

“With vast hydropower resources, the largest youth workforce globally, and 65% of the world’s remaining arable land, Africa’s role in the global future is not optional—it’s essential.”